Anytime a ponzi scheme or get-rich-quick scheme crashes, it tends to reignite the prejudice towards Fintech Applications; most notably, Palmpay and Opay. Memes, publications and writeups likening the defunct ponzi scheme to popular Fintech Applications and many other MMO (Mobile Money Operators and Micro Finance Banks).

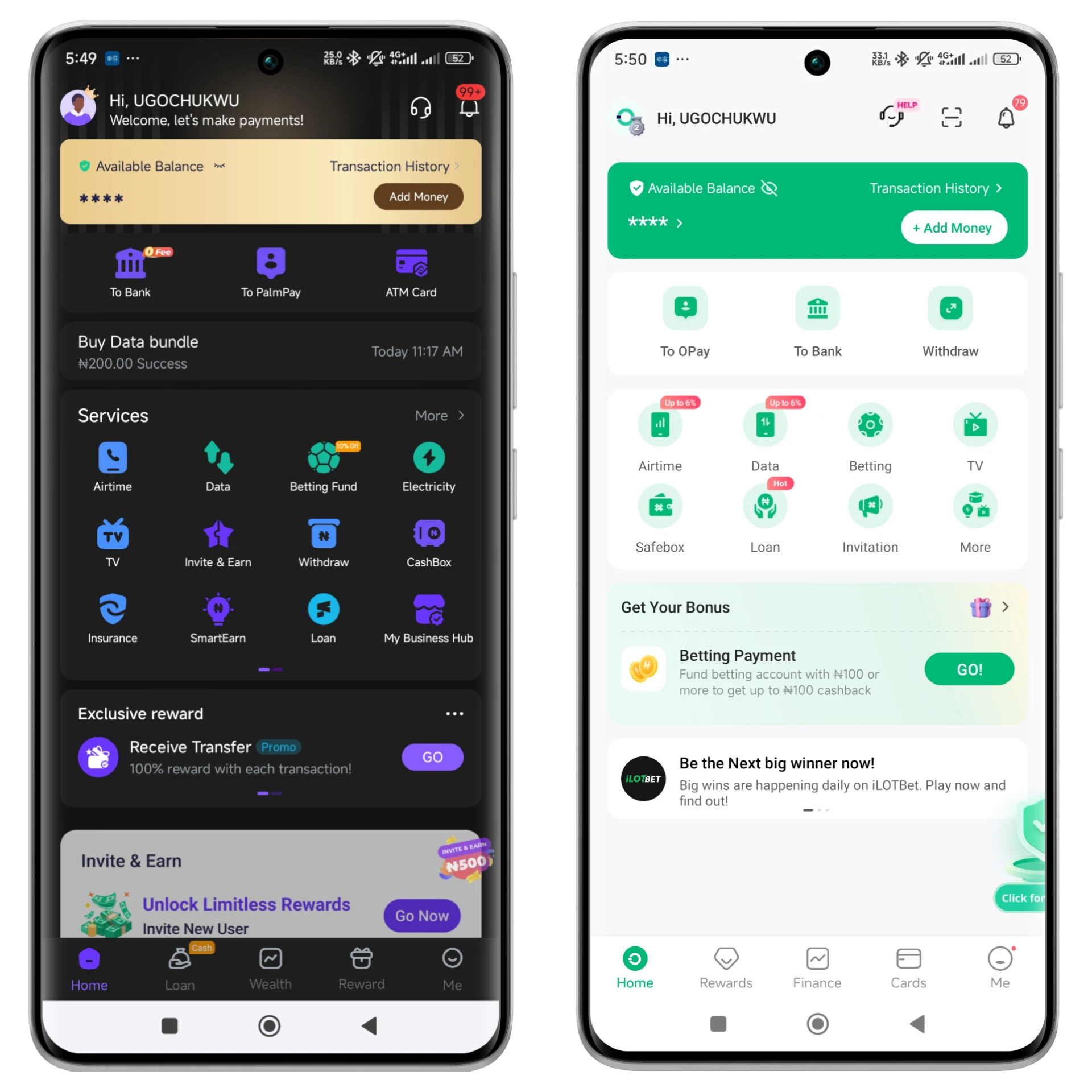

Most recently, a popular ponzi scheme known as CBEX, crashed, culminating in massive loss of funds and more critically, the hard earned trust they had won in the few months of operation. Consequently, some individuals started making videos and memes comparing Opay; the most popular mobile money operator in Africa to CBEX with some going as far as warning others not to save money on the platform.

As someone who spends much time on the Internet and understands what a Fintech is to a good extent as well as, the difference between a Ponzi scheme and a Microfinance bank or a Mobile Money Operator, I decided to put up a publication to counter the unfounded comparisons and at the same time, enlighten those who are still jittery about using MMO or microfinance banks out of fear of crashing or liquidation.

NB :- This is not in any way a promotional content or material aimed at convincing you to use the aforementioned services. It’s meant for educational and awareness purposes ONLY!

What is a Ponzi scheme?

In order to better understand where we are headed, there is need to understand what ponzi scheme or hyip schemes are.

According to Investopedia, a Ponzi scheme is an investment scam that pays early investors with money taken from later investors to create an illusion of big profits. A Ponzi scheme promises a high rate of return with little risk to the investor.

Any website, platform or Mobile Application that promises to pay users exorbitant interest on a daily or monthly basis without doing anything at all is a ponzi scheme. They often launch some type of tasks or activities to make the users believe that the extra profit is being worked for but in the real sense, they just use the money deposited by existing users to pay anyone requesting for payment.

Key Identifiers of A Ponzi Scheme

There are certain key indications that a website or so called earning platform is not really legit but a ponzi scam and they are as follows;

- Unrealistic returns – this is the most common indication that a platform is a ponzi scheme. If you are asked to deposit money to earn a daily interest of 30% or even less, then there is a high chance you just walked into the den of a scammer. Whenever a purported “investment scheme” offers you rates that are exceedingly higher than typical bank rates, then that’s a huge enough red flag.

- Pressure to Invest quickly – this is another sign that you are about to join a ponzi scheme. If a scheme you just found out is being promoted massively to you with a significant pressure to invest money in order not to miss out, then there is a high chance it’s a scam. The reason is, most ponzi scheme promoters are usually crew members of the main administrator(s) so there is need to be wary of the posts you take seriously on social media.

- Unregistered Investments or Hidden Owner(s) – if a scheme claims to be paying users who invest, then endeavour to find out whether the scheme is officially registered or not. Even if they claim to be registered, conduct due diligence to be sure it’s not a sham.

Opay and Palmpay: Are They Ponzi Schemes?

Opay and Palmpay are Mobile Money Operators and they have absolutely no link with Ponzi Schemes most importantly, there are no similarities. A Mobile Money Operator is a company that makes money related transactions seamless and highly accessible to users.

They provide Financial services such as Sending and receiving money, paying bills, making purchases through mobile phones. In essence, MMOs set out to make financial transactions easy and stress-free for mobile phone users by utilizing technology therefore bypassing the traditional banking systems. Due to the huge reliance of Mobile money operators on technology, they tend to have very few offices in the country.

Reason is, their operation and services are rendered to users electronically and if there are issues, they can easily be resolved over the Internet without having to visit any physical offices or branches. It is for this reason that, they are commonly referred to as Fintech.

Also Read: Cash-in App Review: Legit or Scam? (Fast Crypto-to-Naira Conversion)

Therefore, Opay, Palmpay and the likes i.e. including Microfinance banks have no relationships with Ponzi schemes. They operate at a different level. While ponzi schemes are unregistered investment schemes offering high rates for depositing money and not doing nothing else, Fintech Applications like, Opay and Palmpay are registered companies that are out to provide financial services to users in order to make transactions more easy.

Thus the only thing, they have in common is that they all deal with Money — financial transactions.

Why Opay and Palmpay Cannot Crash like Ponzi Schemes

Opay and Palmpay as well as the numerous Mobile Money Operators cannot crash same way ponzi schemes do and there are more than a thousand reasons for this. Don’t get me wrong though, Banks, Microfinance and Mobile Money Operators could face financial crises which may even lead to liquidation.

I mean, we witnessed same with the liquidation of Heritage Bank (a relatively popular bank). But the “crash” of a ponzi scheme can never be likened to liquidation of a regulated Financial company like Opay. Reason is, there are agencies Charged with the responsibility of overseeing the activities of most registered institutions providing financial services.

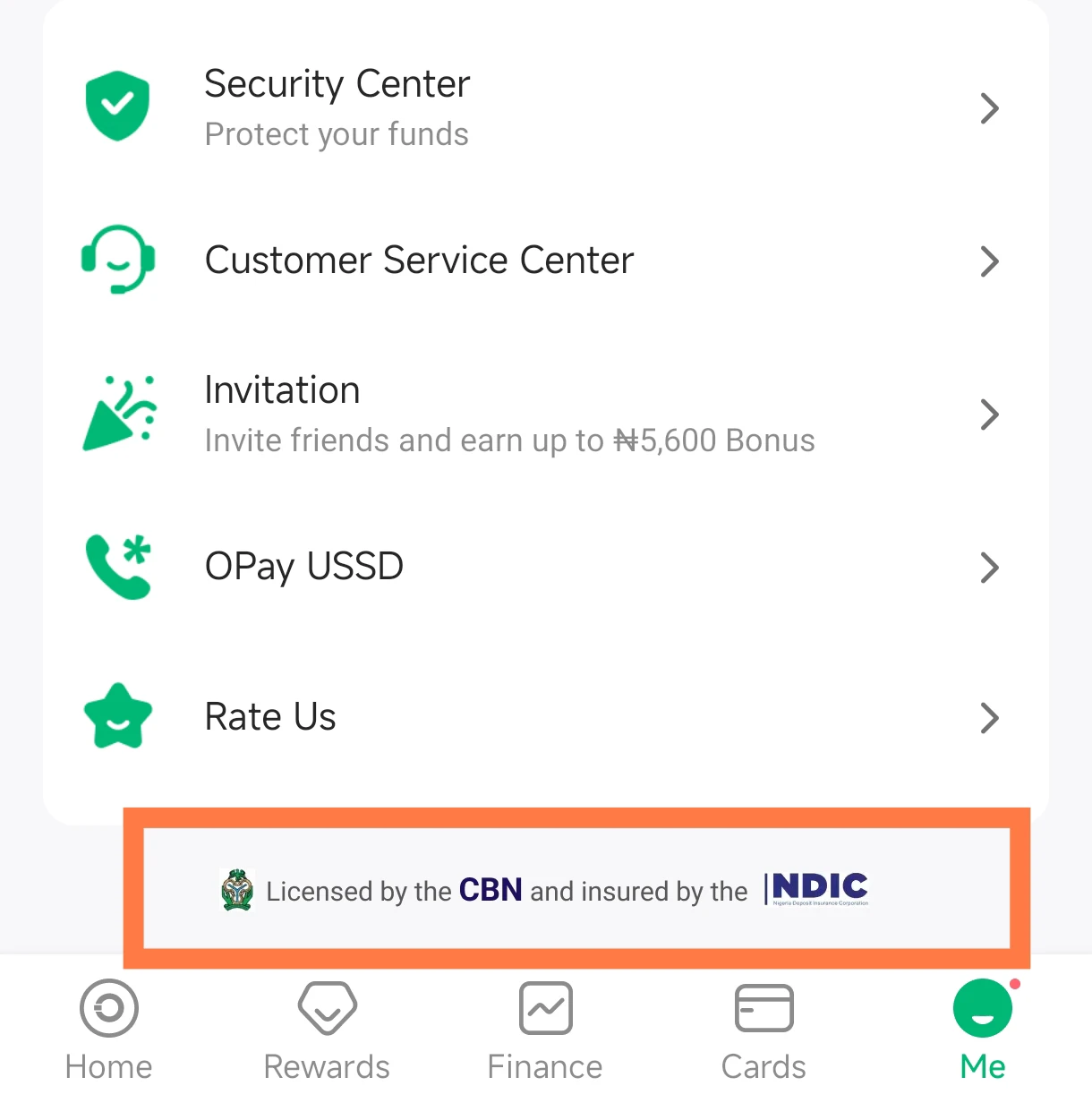

Deposits On Opay and Palmpay Are Insured By NDIC

NDIC stands for Nigerian Deposit Insurance Corporation and it’s a body that was formed following the promulgation of Decree No. 22 of 1988 now NDIC Act No 16 of 2006 (due to the transition to Democracy) charged with the responsibility to stabilize the banking systems as well as macro-economy.

The corporation is responsible for insuring the deposit liabilities of all deposit-taking financial institutions such as Universal banks, Microfinance banks as well as Mobile Money Operators. It’s aimed at protecting the deposits of users in case of financial crisis or liquidation of the bank or financial service.

Therefore, if a Mobile money operator “crashes” as many like to put it, the deposits made by users will be paid by the NDIC as the insurance coverage extends up to 5 million for each user. For instance, if you had 500,000 naira on a Fintech insured by NDIC, and then the platform starts having financial crisis or even liquidates, your 500,000 naira will be paid to you by the corporation.

What you should look out for while trying to join any financial service or company is, whether the deposits are insured by NDIC and whether they are duly licensed by CBN. For Opay and Palmpay as well as some other popular Microfinance banks such as Fairmoney and PSBs (payment service banks) such as MoMo, are all insured by NDIC. You can check out the updated list of Financial service providers insured via a publication on Nairametrics.

On the contrary, when ponzi schemes crash or cease to pay, all the monies deposited by the so called “investors” never get paid back to them. The monies are often diverted and stolen by the unscrupulous individuals in charge of the scheme — the difference is glaring.

Licensed By CBN –

Opay and Palmpay are duly licensed by the Apex Bank and also fully recognized by all financial bodies in the nation. Therefore, it’s almost impossible for them to crash and cart away with the funds and deposits of users. Opay boasts of having over 18million users and thousands of agents all over the country and beyond, therefore what makes you think that, the FG will sit and watch a company as big as that fold up with the millions and probably billions of citizens?

Therefore, people running from Fintech like, Opay and Palmpay are just running when no one is chasing.

Opay’s Valuation :-

The valuation of a bank or MMO is the worth of the financial institutions and it plays a key role in determining it’s ability to approve loans, make significant acquisitions and even engage in investments.

Therefore, to access the strength of a financial institution and it’s backing, there is need to know what the valuation is. In 2021, Opay’s valuation rose to $2 billion after raising investments from its investors, Softbank and Sequoia boosting its valuation to a whopping $2bn but in 2025, the valuation has risen significantly to $2.75 billion making it the second largest Fintech by valuation behind flutterwave ($3bn)

The valuation is a testament to the strength and worth of the institution and as such, the chances of liquidation is impossible.

Conclusion

From what we’ve discussed so far, I believe you have seen the clear difference between Mobile Money Operators like, Opay and Palmpay from Ponzi schemes aka investment scams. Opay and Palmpay Cannot “crash” the way you think — in case of financial crisis or liquidation, deposits made by the users will be refunded to them by the NDIC.

It’s an extreme case that may never happen till the end of life. So stop being jittery whenever you hear about these financial institutions; not having physical offices or branches everywhere drives home the fact that they utilize technology to make financial transactions seamless.

If branches were strong indications of legitimacy and strength, why did Heritage Bank liquidate?

Join Our WhatsApp Channel